Knowing the advantages of Virtual assistant fund

Going for between good Va mortgage and you may a conventional mortgage should be a crucial choice on the path to homeownership. But really, just in case you meet the requirements, the fresh decision is usually clear: Va financing typically render unequaled experts that make them the latest superior choice.

In this post, we are going to mention why Va fund appear as leader to possess eligible individuals, shedding light to their unique advantages and you will considerations so you can take advantage of told decision for your house to invest in travel.

Virtual assistant loan versus. old-fashioned mortgage: Which is greatest?

If you are qualified, a beneficial Va mortgage can often be better than a normal financing. You can buy property with no advance payment, a top personal debt-to-earnings ratio, without private mortgage insurance. You are along with gonna payday loans online Montana provides a lower life expectancy mortgage rate and you will reduced monthly installments. People perks are difficult to conquer.

As well, traditional funds be much more versatile and will be used to pick whichever property – and another household otherwise vacation house. While doing so, there are not any unique eligibility criteria to be considered.

Keep in mind that extremely Virtual assistant-eligible consumers is only able to have one Virtual assistant loan simultaneously. Thus to buy one minute house would commonly need a normal loan. Your own Va entitlement are used for a couple of finance in some circumstances; but, when you need to purchase a supplementary home, your likely need to take a normal mortgage despite the experienced standing.

Obviously, every type away from loan has its cons, as well. Find out about the benefits and you may cons off each other loan models before generally making your decision.

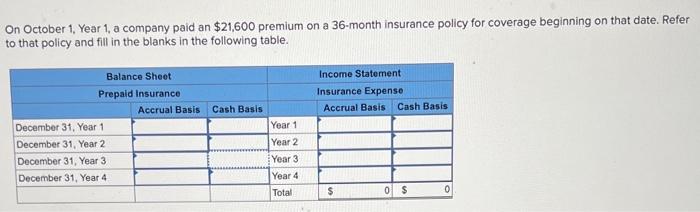

Conventional loan against. Va mortgage investigations

While the an experienced, you always feel the independency buying a house having fun with possibly a good Virtual assistant mortgage or a conventional financing. To easier evaluate a good Va financing so you’re able to a normal mortgage, read this chart:

Differences between Virtual assistant financing and you will old-fashioned loans

Virtual assistant fund and you can antique finance are a couple of well-known alternatives for resource a home, even so they differ significantly during the qualifications standards, deposit standards, and you may home loan insurance rates, with Va financing will offering alot more positive terms and conditions for eligible pros and you can services people. Let’s take a look at some of the key distinctions.

- Eligibility: People family customer can put on to have a traditional mortgage. But with a great Virtual assistant financing, you truly need to have Va qualification by way of armed forces services, reserve services, or Federal Shield solution or perhaps a thriving lover off a experienced just who died into the handle otherwise of an assistance-connected issues or handicap. says Leanne Crist, financing administrator during the Home loan Network

- Deposit: Va financing succeed 100% resource (zero down payment), whenever you are traditional funds typically want about step 3% off

- Mortgage insurance: Traditional fund require that you purchase private mortgage insurance coverage (PMI) for those who set lower than 20% down. Virtual assistant money don’t need one lingering financial insurance costs, but you is charged good Va capital percentage that usually averages 1% to 3.6% of loan, dependent on your deposit

- Assets requirements: Virtual assistant fund could only be employed to purchase an initial quarters, if you find yourself conventional family purchase funds are used for top houses, second belongings, otherwise rental properties

- Bodies make sure: Good Virtual assistant financing was supported and you will protected by the U.S. Company out-of Veterans Facts, whereas a conventional financing is actually [usually] supported by Fannie mae or Freddie Mac computer, says Sam Atapour, branch movie director to have Incorporate Home loans

- Debt-to-money ratio: This new Virtual assistant hasn’t depending a DTI proportion limit, but the majority Virtual assistant lenders have a tendency to examine individuals that have high rates. At exactly the same time, it’s best to provides good DTI under 43% for a normal financing