Nowadays, choice and online loan providers, particularly Kabbage, were increasing. This can be primarily due to the feature from option loan providers in order to utilize technical and offer more readily obtainable business funds. They also have flexible qualifications criteria, particularly in regards to fico scores and you may annual dollars moves.

Inside book, we are going to break apart the brand new Kabbage business money to aid you determine if its loaning choices are best for your organization. DoNotPay makes it possible to raise your chances of mortgage recognition by starting a concise and you can persuading financing request letter for you.

What type of Business Funds Does Kabbage Provide?

Kabbage provides business money in the way of contours away from credit, which happen to be funded by the American Express National Lender.

That have a personal line of credit, your business is tasked that loan restriction as possible draw out of as soon as you need to have the currency. It indicates you could receive one amount borrowed any time, provided that you don’t surpass the credit limit.

- Secured personal line of credit-Needs you to set a valuable asset since collateral in the event you are not able to spend the money for loan

- Unsecured line of credit-Does not require security on how Resources best to secure that loan

- Revolving credit line-Performs same as handmade cards. All get numbers is actually subtracted from your own acknowledged borrowing limit, if you are repayments heal it

- Non-revolving line of credit-Enables you to obtain immediately after, and you also you should never make use of the limit after you repay this new financing

Kabbage will bring merely rotating lines of credit to have small businesses. This makes it you’ll be able to to make use of the income for various motives, eg:

- Financial support everyday functional costs

- Since the costs off starting a corporate or typical startup costs

Kabbage Small company Finance Qualifications Criteria

Just like any other type out-of business loan, you have to meet what’s needed so you can qualify for Kabbage money. Your organization has to be working for at least 12 straight months and possess a legitimate organization bank account. The new organization must have seen a western Display business card for around a couple months or even to was recognized to own Kabbage capital in past times.

Regards to Kabbage Home business Financing

The newest regards to Kabbage financing, such interest rates and mortgage wide variety, decided situation by the circumstances-but the rates are generally higher than that from other investment options, particularly SBA fund.

- Monetary analysis in the accounts you link in your software

- Month-to-month company cash

- Time in company

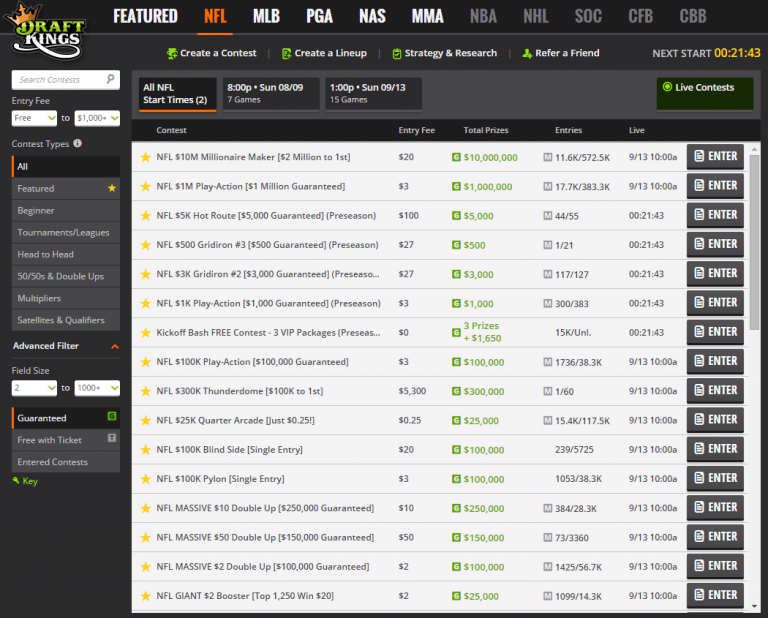

Once you implement, Kabbage will state your of your conditions they pick befitting your company. The fresh new desk less than will bring a listing of the usual Kabbage terms:

Kabbage Business Loan application Processes

Kabbage funding programs are recorded on the internet within a few minutes. To find financing, you must complete the on line form on their site. The mandatory guidance comes with:

You ought to plus make it Kabbage and come up with a challenging query on the your very own and you may providers credit history. If the application for the loan is approved, the income are taken to your money, that can occupy to 3 working days, based on the lender.

A Kabbage personal line of credit is not long lasting. Its at the mercy of unexpected recommendations and can getting frozen or eliminated in the event the you need to.

And then make Costs for a beneficial Kabbage Small business Financing

The first checking account your be sure in your app techniques is considered most of your membership. Which membership caters to having deposit financing and you may withdrawing costs. When you take on the loan arrangement, you allow Kabbage to automatically withdraw funds from the key membership having mortgage money. This is accomplished immediately to the month-to-month repayment dates. You can examine this new due date and you can count regarding Funding Overview part of your Kabbage account.

Boost your Odds of Delivering that loan by using DoNotPay

Step one for the protecting small company loans is understanding how they work. Then, you ought to make sure that your app data mirror what loan providers come across.

Probably one of the most very important data is actually that loan consult page. It says to the lender concisely as to why they want to money the short organization. We could help you draft a convincing mortgage demand letter inside a minute. Realize such simple steps to truly get your letter right away:

If for example the identify a knowledgeable business money doesn’t end that have Kabbage, you can attempt choices to pay for your finances, such:

We could help you find new available on the net lenders fast and you may stress-free. Unlock DoNotPay and locate our very own Pick Web business Financing Financial device to really make it happen.

Protect The Brand and Create Believe Along with your Profiles!

One of the most tricky regions of every single business are strengthening a trusting reference to the shoppers and you may keeping a strong reputation. That is why it’s very important to safeguard your organization label, expression, and you can motto legitimately of the joining it as a signature. DoNotPay will be here to accomplish that hassle-100 % free with these Signature Subscription equipment. Need assistance examining to have signature abuses after you check in? You do not have to help you worry while we provides a hack that will help you with this as well!

Now that your own trademark was off the beaten track, you should consider conforming having studies protection requirements when planning on taking care of the users‘ confidentiality. You are able to do thus that with our Confidentiality Shield Worry about-Certification product.

Have you been making reference to fake negative on the internet feedback which might be hurting your organization? DoNotPay makes it possible to by checking out user reviews and you can revealing him or her up until he’s disassembled!

Day Was Currency, and you can DoNotPay Will save you One another!

DoNotPay offers an array of day-saving has that you can use if you do maybe not feel including making reference to company-relevant demands on your own. We could make it easier to:

Do you need help writing on members that do n’t need to pay for your services? Fool around with DoNotPay’s Infraction from Bargain device to transmit a page off request within just times! Undecided what to do having unjust chargeback needs? We could help you by creating a good chargeback rebuttal document to own that posting towards payment processor.